Pezesha means Financial Empowerment. This is our ultimate mission in ensuring our digital financial infrastructure continues to be relevant and essential to all stakeholders in our value chain, be it individual borrowers, digital lenders, banks, MFIs, MSMEs among others.

Our value chain is unique in that it focuses on the onerous task of addressing an end to end long term solution and not just short term financial needs- like using credit as a means to an end. It all starts with financial literacy, credit scoring, matching and credit deployment on behalf of our financial partners and lenders.

For starters, Pezesha is NOT a lender, we are a proven crowdlending-as-a-service blended with credit -scoring as a service holistic platform. We do not lend from our own balance sheet, and where we do have skin in the lending, is to test, validate and verify our credit scoring models are robust and reliable to ensure our lenders derisk their funds and build trust which has this far been strengthen from our strategic partnership with Capital Markets Authority, leading to commercial banks being interested to collaborate with us in the last few months.

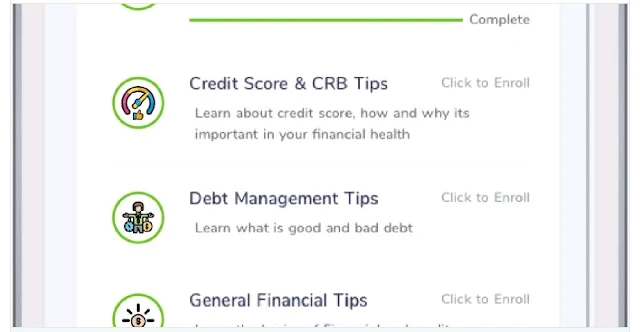

We are excited to deliberately launch our Pezesha Financial Academy built from more than 40 million data sets analysis in a span of 3 years to ensure a strong framework that is personalised contextual and inductive, for both LENDERS & BORROWERS and allows for cross platforms channels be it videos, SMS, mobile apps, mobile web etc.

1.For Borrowers (Individuals, MSMEs, Millennials)

- Get FREE financial tips to reduce debt stress, debt traps, cash management during and post COVID-19 crisis to ensure responsible financial behaviour. We empathise that the financial stress is even more for underserved and low income borrowers as our target focus.

- REGISTER HERE or download our app from Google Play store to start learning financial tips that take you to the next level of your personal financial growth.

2. For lenders, Banks, CRBs and other financial institutions

If you care about your customers, then this is the time more than ever to grow their financial health as it increases customer loyalty in the long term.

- Get FREE financial education APIs that are simple and secure to implement and integrate to your existing mobile apps in a matter of days. You don’t need to reinvent the wheel, we have done the hard job for you, tested and proven our APIs and modules by already educating more than 5,000 customers through our existing partners.

- Strengthen your customer loyalty: Most digital lenders have halted their lending for now to reduce default risk, implementing our financial education APIs, allow you to use this time to strengthen your customers/borrowers financial health and retain them post the current pandemic.

- Real time analytics on the interactions of your customers with the different modules at any given time, and then analyse the data for further insights to help you better understand the gaps and needs of your customers behaviour in relation to their financial health status.

- If you do not have a technical team, not to worry we will do all the implementation for you with our capable team and it will only take us a couple of days to do so.

- You have the flexibility to customise and contextualise the financial literacy to your brand and add additional personalised modules/tips to only a certain segment of your customers..

REGISTER here http://shorturl.at/iHLPS if interested to leverage our APIs for financial literacy module and we will follow up to set you up.

Now that the Central Bank of Kenya recently issued a new directive for unregulated mobile Digital lenders not to list defaulters on CRBs (Credit Reference Bureaus), this is an opportune time to leverage on financial literacy to educate your borrowers and customers on responsible repayment in the short and long term and how it affects their financial growth in the long term to then better understand and predict their willingness to repay behaviour post COVID-19.

Please note our FREE APIs can work in any country and are not limited to Kenya.

Value to Borrowers & MSMEs:

We are encouraging all borrowers and MSMEs to use this downtime to examine their finances and prepare for a possible change. More so, look at this as an opportunity to get stronger in their financial health through taking the FREE modules from Pezesha Academy with an objective to benefit from future credit and other financial services from the market.

Financial education plays a pivotal role in preparing people to face economic challenges in tandem, increasing their confidence to manage money during a crisis, and how it can lead to recovery as quickly as possible. When this crisis comes to end, those who use this time to learn and sharpen their financial literacy skills will be much stronger in financial health than ever before leading to true financial wealth in the long term.

Value to Digital lenders, banks, government and other stakeholders:

We also encouraging governments, banks and other service providers to also go ahead and implement our FREE financial literacy program during this COVID-19 period in order to ensure every citizen reflects on their financial health during this time as financially included people are better prepared to manage cash flow and mitigate risks, and thus more likely to be economically resilient as financial and physical wellness are directly linked. Financial stress now aggravated by COVID-19 could be the leading cause of current lost productivity, overindebtedness, and anxiety. Financial literacy cannot predict or remedy a crisis, but it certainly will be a diminution when it comes to debt and economic recovery.

Let’s collaborate to increase Financial health at a national level during this Pandemic

Kenyans financial well-being in 2019 was at 22%. This was a 17% drop from 39% recorded in 2016. This means that Kenyans are less likely to manage their day-to-day finances, cope with risk, and invest in the future than they were three years ago. People’s ability to cope with shocks also declined, with fewer people setting money aside for a rainy day or able to access a lump sum in case of an emergency according to FinAccess report 2019. This is why as part of our fiduciary duty at Pezesha we will continue to be an advocate of financial literacy to reduce these gaps hindering our ultimate mission of financial empowerment.

Join us today to drive Financial Health to at least 5% increase in the next 12 months. We cannot do it by ourselves. It’s a collaborative effort for the ultimate public good. We also welcome financial institutions, digital content developers, academia and researchers working on matters of financial literacy to crowdsource and develop quality financial content to as many people as possible. If interested to collaborate and create impact reach out to us at hello@pezesha.com

Advertisements

Write a comment

Post a Comment

Loans Kenya Blog admin will never approve abusive or inciteful comments. In addition, avoid including sensitive or private personal information in your comments for your own online safety.