Can one really rely on loan apps for sustainable financial assistance? Is it possible to trust loan apps for business growth? Are these apps predictable?

I have received many messages, calls, emails and even blog comments from various people who interacted with one or more of the loan apps in the Kenyan lending market complaining of unpredictability.

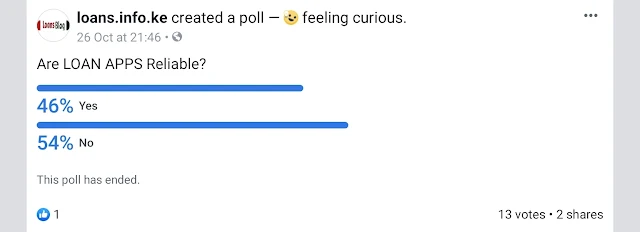

I even did a small poll on my facebook page and these were the results; 54% No and 46% Yes.

Many said they had to close down their businesses after being disappointed by the apps they really depended on for quick loans.

The loan limits drop unexpectedly down to zero from highs of kes50000 at a time when one expected to pay and take a new loan right away to pay suppliers !

What happens is that the app will promise a higher limit after payment of existing loan. Next a trader decides to pay the loan early using money set aside for stock buying so that he/she can enjoy the loan limit rise and buy even more stock. Surprisingly that's when now the limit immediately drops to zero and trader becomes not eligible for loans after being a loyal customer all that time.

I understand not all customers can be eligible but even the eligible ones fall into this mess mistakenly. Yes, and after everything is messed up let's say after a week or so, the same app tells you that you're now eligible for loans. Other apps declare you ineligible indefinitely.

What am I saying here? The thing is, these loan apps are not reliable especially if you're doing business and depend on these loans. They're a disappointment at times. Just interact with loan apps with caution.

Advertisements

Write a comment

Post a Comment

Loans Kenya Blog admin will never approve abusive or inciteful comments. In addition, avoid including sensitive or private personal information in your comments for your own online safety.